A comparative look at Indian and German labour laws.

---------------------------------------------------------------------

Normally, a set of Acts constitute the labour laws in a country. The common features are.

-Health and Safety

-Minimum Wage

-Payment of Bonus

-Maternity and paternity and vacations

-Insurance and Pension fund.

- et al

There are three legal entities: Employer, Employee and the Company. Most of the times the laws apply irrespective of the nature of the company. For example any firm/individual employing more than 20 employees is considered a factory according to Factories Act 1948, India. The Companies Act 1956 regulates different aspects of a company. (http://www.laws4india.com/corporatelaws/comp_act/ica_idx.asp, http://www.dgfasli.nic.in/html/dockact/rule1.htm). It is the responsibility of the employer to provide a safe and healthy working environment in any factory. This includes rest rooms and other facilities as may be required depending on the nature of the job. There is also a maximum working hour limit. In India it is 10.5 hours with 30 minutes of break after every 5 hours of continuous work and the total for the week may not exceed 56 hours. In Germany it is around 38 ours a week but the daily working hours may go up to 10.5 hours. There should also be an extra payment for every extra hour worked. The wage differs in different countries. In India any work done after 9 hours of work is considered a over duty.

There is no minimum wage specified in several countries, like in Germany. In India The Minimum Wages Act 1948 stipulates a minimum wage. However there is a minimum wage specified for immigrant high skill workers to avoid import of cheap labour. It is around 50,000 Euro per year in Germany.

There are 24 paid leaves per year in Germany and 21 in India excluding other holidays. In Germany there is also a 6 weeks of paid leave in case of illness. It’s around 15 days in India. There is no paternity leave in India as in Germany. Women get a 3-month maternity paid leave in India.

Payment of Bonus is compulsory in India according to Payment of Bonus Act 1965. There is also a compulsory Gratuity payment. More information is elsewhere (http://www.laws4india.com/labourlaws.asp). In Germany there seems to be no such mandate.

Pension fund must be through equal contribution by employer and employee to the Employee Provident Fund in India and to Social Security Organisation in Germany. This sum is around 12% of the gross salary. However Employee may choose to set an additional amount aside through a fund formed by the company for the purpose of pension. This is completely exempt from income Tax.

This amount is deposited in an account. Called EPF account in India and Social Security Number in Germany. In Germany this amount can be withdrawn, three years after the leaving the country if the employee is an immigrant worker. However only employee’s contribution shall be returned and the rest will lapse. The money will be immediately returned if the employee has not stayed in Germany for more than three months.

More information can be found on all Indian Acts here (Searchable by key words)

http://indiacode.nic.in/sht.asp

After receiving all these its the duty of the employee to work honestly for the betterment of the enterprise!

As part of Electronic Initiative on "civic responsibility and rights campaign"

Mr. Raghavendra S Kattinakere

Executive Trustee

Centre For Development Research

PMM Trust (R), Kattinakere

India, 577434

www.geocities.com/pmm.trust

cfd.research@gmail.com

Subscribe to:

Post Comments (Atom)

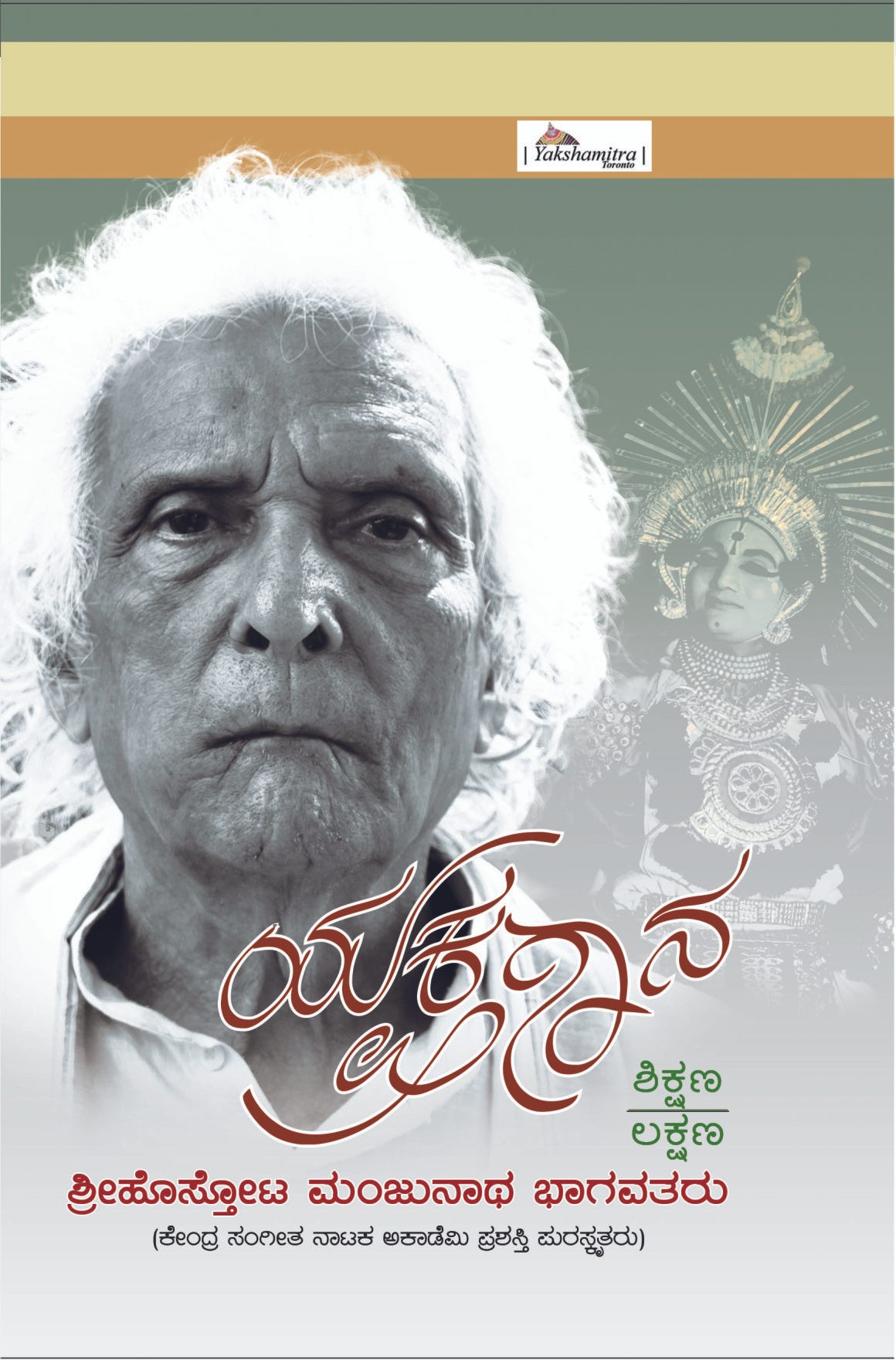

ಯಕ್ಷಮಿತ್ರದಿಂದ ಹೊಸ್ತೋಟ ಭಾಗವತರ ಯಕ್ಷಗಾನ ಲಕ್ಷಣ ಗ್ರಂಥ ಪ್ರಕಟಣೆ

ಪುಸ್ತಕಕ್ಕಾಗಿ ಸಂಪರ್ಕಿಸಿ ಅಮೇರಿಕಾಸ್: +16473283934 ಭಾರತ — ರವೀಂದ್ರ ಮುದ್ರಣಾಲಯ ಸಾಗರ, ಮೋ: +9194495872...

-

[This is a Screen Shot -Visit http://shruti.hejje.com for Yakshashruti] I have created a small application that allow...

-

This post solves an illusion/riddle named Spinning Lady, doing rounds on the Internet and demonstrates how to get rid of the illusion. F...

Some figures need verification. Please confirm thrm before you use them in your arguments!

ReplyDeleteHi,

ReplyDeleteThere are only for information. I have written most of them out of my memory. This was an attempt to give a rough idea. When one wants to use them all of these need verification. This is as authentic a blog could be. Thank you for the advice.